Does your Order-to-Cash business process provide you optimal bottom-line results? Improving just your production process time only provides 21% of the savings from the Order-to-Cash process. Acuity Dynamics’ metrics-drive approach can quickly assists to uncover your hidden opportunities to get the remaining 79%!

Our offer to you: A FREE competitive analysis of your business, see example below.

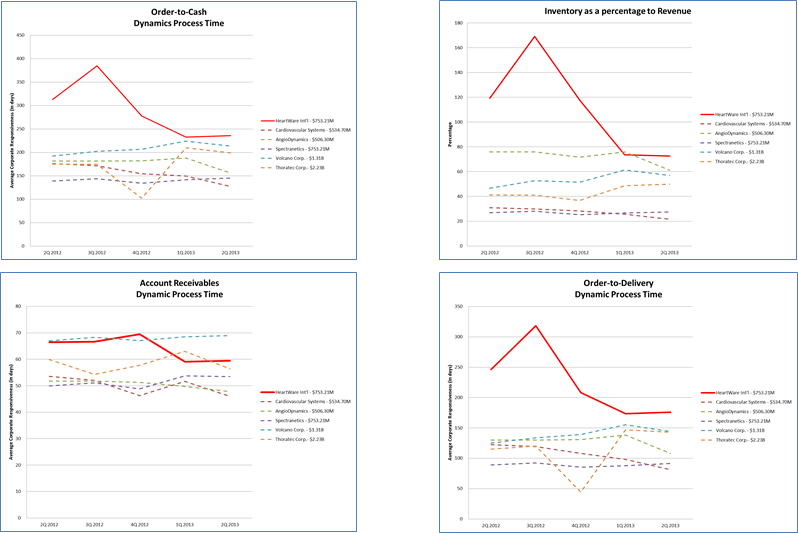

Sample Competitive Analysis Findings

Current results when compared to Manufacturer’s leading peer/competitors’ averages:

-

• Order-to-Delivery (OTD) responsiveness is 62.6 days longer• Accounts Receivable responsiveness is 6.9 days longer

Reducing Manufacturer’s average “corporate-level” responsiveness by one day can:

• Reduce inventories by $210 thousand plus an additional $27.8 thousand carrying cost (assumes 18% carrying cost)• Reduce account receivables by $565 thousandReducing Manufacturer’s average “corporate-level” responsiveness to within their leading peer/competitors’ averages will:

• Reduce inventories by $13.1 million plus an additional $2.4million inventory carrying cost (assumes 18% carrying cost)• Reduce accounts receivable by $3.9 million

Acuity Dynamics assists in:

- - Solutions custom tailored to your business needs.

- - Typical implementation is 30-90 days from initial engagement

- - Typical payback is three to six months following implementation

- - Providing manageable and actionable information

- - Quickly identify business process constraints at all levels

- - Understanding your Order-to-Cash Baseline and Optimized performance goals

- - Ensuring remove constraints do not migrate to another business processes

- - Monitor discipline of improved IT systems and business processes

- - Creating synergized organization